The U.S. Economy Will Continue to Deteriorate without Effective Action

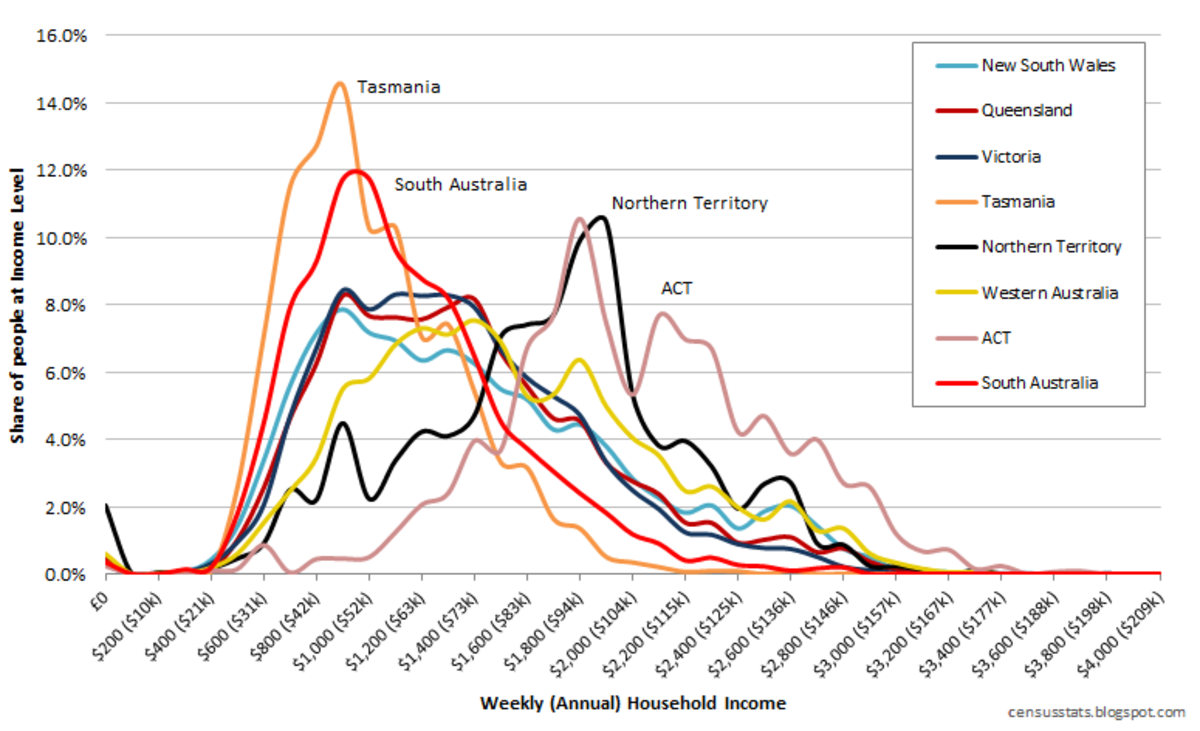

There is an old cliché that says, “The only constant is change.” While that is generally true, there are some things of which we can be fairly certain. Inequality in capitalist societies has been a constant from the time of the first market exchange. The only change is the recent increase in economic inequality in the world. Surplus labor, an economist's euphemism for unemployment, is also a feature of capitalist economies. And despite the misleading official statistics, nearly 15% of workers are unemployed. Other prosperity stunting features of our economy include unaffordable higher education, enormous student debt, and inadequate infrastructure maintenance and development.

Economist Paul Krugman asks, “...what if the world we’ve been living in for the past five years is the new normal? What if depression-like conditions are on track to persist, not for another year or two, but for decades?” What indeed. He implies that events such as the savings and loan or dotcom bubbles increase general prosperity in the short term, but in the end these bubbles only help the wealthy classes and less is left from the dwindling pool of wealth for the middle and lower classes. The last crisis, the housing bubble, gives us a clear example of how bubbles predominantly hurt the lower classes.

There is nothing natural about the rules of capitalism. Governments set up the rules under which people make money, hire labor, utilize resources, pay taxes, and use capital. Moreover, the rules of capitalism are set up by people with money in order to perpetuate and increase their own wealth and power. Economics professor Paul Heise agrees, “The rules have been rigged. The so-called financial markets have become a riverboat casino kept afloat by the Federal Reserve's quantitative easing. They are the means by which the already very rich financial sector siphons off huge amounts of money without adding anything to the economy.”

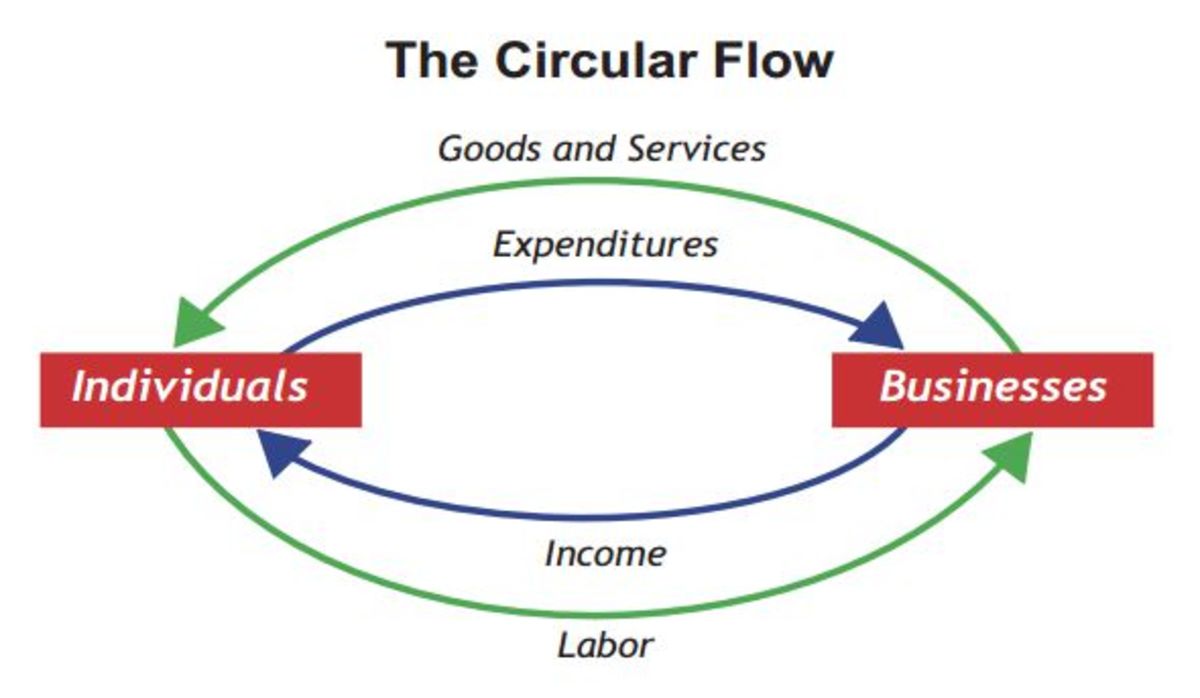

Meanwhile, demand is not increasing due to job losses and debt incurred during the housing bubble. Only through borrowing has the economy stayed afloat in recent decades, and when the debts come due as they did in the Great Depression, economic crash follows. There is little vision in Washington, D.C. about what to do about the continued economic crisis brought on by this debt, permanent job losses and reduced demand. Moreover, when job’s programs or student debt relief, among other solutions, are presented, the forces of austerity, neoliberal fundamentalism and libertarianism block these recovery programs from even being voted on in Congress.

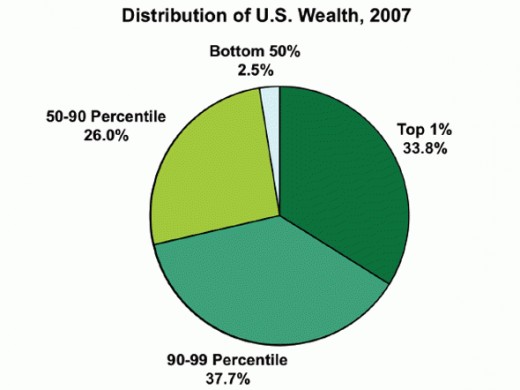

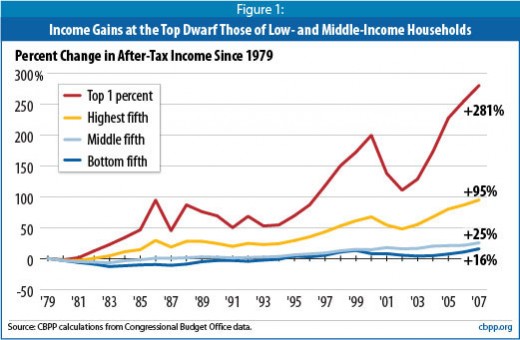

Most government and corporate economists are infatuated with the Gross Domestic Product (GDP), a measure of total production of goods and services in an economy. However, that economic statistic does not measure the well-being of the people. Despite the quarterly emphasis on GDP, rising GDP does little to end the impact the recessionary economy has on the majority of us. In fact, “When incomes are adjusted for inflation, the middle-class American family was actually better off in 1989 than last year, even though in the intervening period GDP grew in real terms by more than two and half times.” Rising per capita GDP fails to create jobs nor increase general welfare. That is because GDP gains have for decades gone to corporations, CEOs and large investors, not the middle and lower classes.

GDP looks at all types of economic activity equally. So, disasters like Hurricane Sandy that caused billions of dollars in damage boost the GDP due to the rebuilding required afterwards. Having to rebuild damaged homes, sewage systems, roads, bridges, power lines and other infrastructure should not be counted as productive, for it is a loss of equity. If an oil company such as Exxon were to drill for oil in the Grand Canyon, it would certainly boost GDP, but at what cost? It would be a loss of a valuable natural resource. However, GDP does not take into account losses or depreciation.

Depleting natural capital such as fish stocks, forests and beaches should not be seen as a net economic gain when there is a loss of future revenue. So the very goals government economists set, rising GDP, are faulty and will not increase the general welfare even when GDP goals are met.

Fortunately, there is an alternative to the GDP, the genuine progress indicators, or GPI. These indicators include not only economic factors but environmental and social factors. Capitalism does not concern itself with anything other than profit in cash, capital and resources. The system of capitalism rewards destruction. (See Naomi Klein’s Shock Dotrine for more about disaster capitalism.)

However, GPI does take into account income inequality which inhibits spending and growth. The added cost of being unemployed is also considered. Pollution of all kinds is taken into account, for those are net losses in usable land and leads to increases in healthcare costs. Social costs such as crime and imprisonment, among other costs, are also part of the GPI.

The actions that need to take place for our economy to improve long-term are daunting. Though GPI can be used to develop a sustainable and equitable economic action plan, I doubt that the political will exists to do anything about the current economic downturn that will help a majority of people in the U.S.

The economic trends in the United States are against recovery and we need to rethink our current, unsustainable economic model. Corporate profits are as high as they have been in decades. Corporations are sitting on, not reinvesting, trillions of dollars of capital. The tax cuts for the 1% are not creating new jobs. Real unemployment is near 15% and real wages have only increased 13% percent between 1973 to 2007, about a 0.04% increase per year.

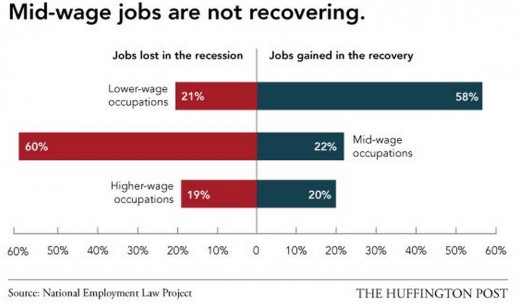

Moreover, the jobs that are returning since the recession started in 2008 are low wage jobs; mid-wage jobs appear to be permanently lost.

The drop in the official unemployment rate in March was in large part due to the decrease in the labor force of 800,000. So, if 800,000 fewer people are looking for jobs, they would no longer be counted in the official unemployment statistics. And if 800,000 people lost jobs in March and 800,000 left the unemployment roles at the same time, the government would count that as a zero percent increase in unemployment when actually 800,000 more people were without jobs.

According to the Bureau of Labor Statistics, of the 80 million families in the United States, 80% had at least one employed member. That means 20% of U.S. households have no one working.

One in every six people in the U.S. receive food stamps, and 15% of us live below the poverty line. Moreover, 4.4 million people have been out of work so long that they have left the workforce. These numbers belie the rosy picture we hear from administration economists and mouth-pieces. And there is no end in sight to our recession such as a job's program, investment in infrastructure or a massive increase in U.S. manufactured exports.

According to the American Society of Civil Engineers (ASCE), who gave our infrastructure a grade of D+, “Overall, if the investment gap [in infrastructure] is not addressed…by 2020, the economy is expected to lose almost $1 trillion in business sales, resulting in a loss of 3.5 million jobs…the cumulative cost to the U.S. economy from 2012–2020 will be more than $3.1 trillion in GDP and $1.1 trillion in total trade.2” Not only would rebuilding infrastructure create jobs, it would be a boost in sales and be an overall savings of trillions of dollars for the United States.

Unemployment for construction workers is in double digits. With interest rates low, and with high demand to improve our infrastructure, now would seem like the right time to rebuild bridges, roads, the electrical grid and improve our information superhighway. However, the irrational ideology of austerity that pervades in Congress prevents necessary spending in infrastructure to create jobs and improve our nation.

Another investment that we are losing out on is education. About 50% of students that enter college don't graduate. That is not only a loss in a college investment but a decrease in trained workers that politicians talk about with the refrain, “Workers aren’t ready for skilled jobs.”

But what are they doing to help students get through college for the “jobs of the future”? Congress cut Pell Grants for college students and refuse to cut interest rates on student loans. Now students are in thousands of dollars of debt with no job prospects or are having to take jobs that pay too little to help them pay off their debt.

In 2005, the average student loan was just over $17,000. In 2012, it’s over $27,000. Whether it’s the rising cost of tuition or the rise in interest rates of borrowing, students are trapped in debt and thus, “delaying major life decisions, like buying a home or car, as a result of their student loans.” Graduates with huge amounts of debt can’t afford to spend when they graduate, and the economy suffers.

As Noam Chomsky often does, he gets to the heart of the student loan crisis, “"Students who acquire large debts putting themselves through school are unlikely to think about changing society, Chomsky suggested. “When you trap people in a system of debt . they can’t afford the time to think.” Tuition fee increases are a “disciplinary technique,” and, by the time students graduate, they are not only loaded with debt, but have also internalized the “disciplinarian culture.” This makes them efficient components of the consumer economy.""

There is nothing to suggest that the U.S. economy is coming out of its downturn. Healthy gains in the stock market go to wealthy Americans, good paying jobs are now low wage jobs, our infrastructure is falling apart, and a higher education no longer leads to prosperity for millions of graduates. Unless our economic system changes and laws that pander to the richest in the U.S. are overturned, our economy will transform into a feudal system of serfs and lords.

Peace,

Tex Shelters